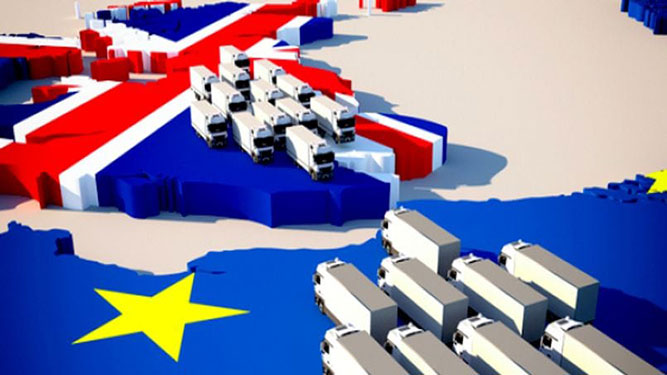

If you wanted to move goods between the UK and countries in the EU, you will need to follow new customs and tax rules.

How your business will be affected by the new rules if you:

- buy goods from an EU seller and bring them into the UK

- send goods you have sold to a buyer in an EU country

- have not exchanged money but need to move equipment that you use for your business, between the UK and the EU

This means change for many businesses, and HMRC will be there to help you in several ways.

You can attend HMRC webinars to help adjust to the new rules and keep your business moving.

If you need any help and advice please Call Customs & International Trade helpline on 0300 322 9434, for more help with importing, exporting or customs reliefs. The helpline is open from 8am to 10pm Monday to Friday and from 8am to 4pm at weekends.